Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

H1 2024 review

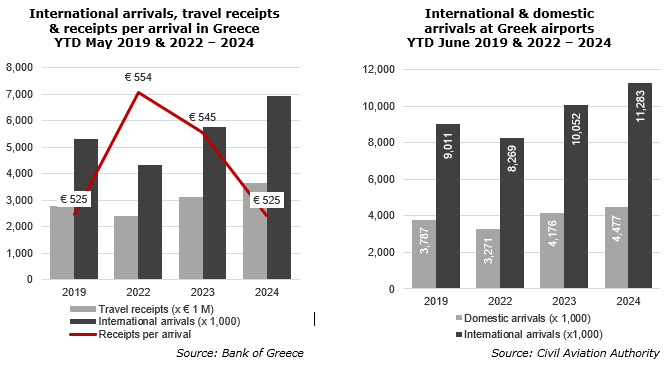

- According to the Bank of Greece, international arrivals and travel receipts increased by 20.6% and 16.2% respectively YTD May 2024/23. As a result, receipts per arrival declined from €545 in 2023 to €525 in 2024 (data up to May), returning to 2019 levels. There are variations by source market: the USA increased the average spend per arrival by 14% from €890 in 2019, while expenditure per arrival declined for the United Kingdom by 8%, France by 3%, and Germany by 3%.

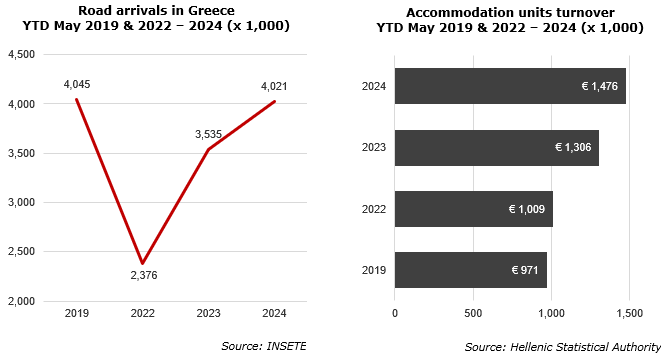

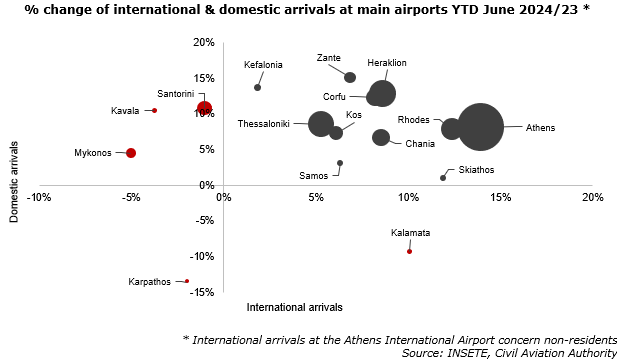

- YTD June 2024/23 international arrivals at Greek airports increased by 12.2%, while road arrivals increased by 13.7%. The road arrivals remain slightly below 2019 level.

- According to the Hellenic Statistical Authority, turnover at Greek accommodation units increased 12.9% YTD May 2024/23. Based on our monthly survey of the Greek hotel sector's performance, revenue increased by 11.8% YTD June 2024/23.

- Even though the overall picture is positive, except for the decline in receipts per arrival, there are regional differences and areas of concern. As shown below, hotel occupancy has registered little improvement up to June 2024 compared to the same period last year. This suggests that the increased number of tourists are opting for different accommodations, likely Short Term Rentals. The sector is continuously expanding, and the Government has announced that measures will be introduced towards the end of this year. Many international destinations are taking similar steps to regain control. It is also noted that the Bank of Greece data includes day-visitors.

- Not all destinations are registering growth. International and domestic airport arrivals in Mykonos and Santorini have declined, with market sources in the hotel sector indicating a significant decline in performance. Negative publicity, mainly regarding overpricing and overtourism, is continuously published. The latter is directly related to the cruise sector, noting that both Mykonos and Santorini exceeded 1 million cruise passengers in 2023.

- In Santorini, 1.3 million cruise passengers and 800 cruise ships arrived in 2023, compared to 981,000 passengers and 592 ships in 2019, representing increases of 32% and 35% respectively. In Mykonos, 749 ships with 1.2 million passengers arrived in 2023, compared to 550 ships and 787,000 passengers in 2019, an increase of 36% and 51% respectively. Prime Minister Mitsotakis indicated in June that the Government is planning to implement measures, especially for Mykonos and Santorini

- The existing infrastructure in Greece is insufficient to handle the increased tourism flows, particularly evident in water supply shortages affecting numerous destinations. Fourteen Greek municipalities have been placed under a state of emergency, including those in Crete, Serifos, Sifnos, Leros, Poros, Spetses, and Sami in Kefalonia, as well as areas in Corinth, Alexandroupolis, and Xanthi. Greece experienced multiple heatwaves and limited rainfall, exacerbating the situation

Hotel sector performance

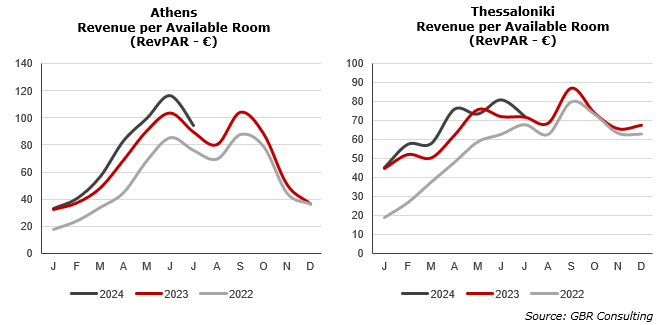

- The hotels in Athens improved their RevPAR by 14.5% during H1 2024/23, primarily due to a 10.7% increase in room rates. Occupancy improved slightly by 3.5%, with February and April performing particularly well, while May and June saw a decline in occupancy compared to the same period in 2023.

- In Thessaloniki, the hotel sector registered an 8.8% increase in RevPAR for H1 2024/23. Occupancy during the first half of this year remained stable, while ADR increased.

- City hotels outside Athens and Thessaloniki registered a decline of 1.5% in occupancy, while ADR improved, leading to a 4.7% increase in RevPAR.

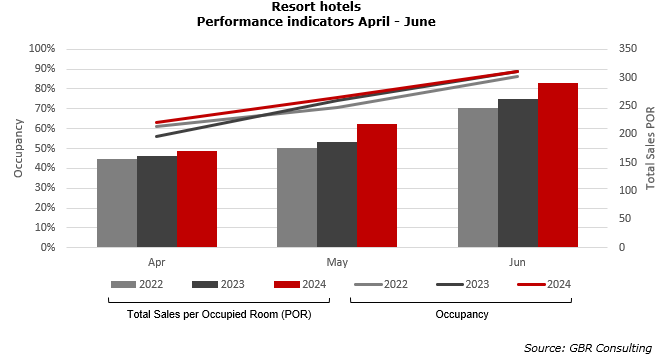

- Resort hotels commenced the season later this year compared to 2023. With fewer rooms available, they recorded significantly higher occupancy in April 2024/23. YTD June 2024/23 occupancy improved by 3.7%. In terms of total revenue, resort hotels achieved a significant increase of 9.5% during the first half of 2024 compared to last year, with Total Revenue per Occupied Room (POR) improving by 13.4%.

Main hotel transactions

- At the end of July, it was announced that Premia Properties acquired its first hotels through a sales-and-lease-back transaction with the Nordic Leisure Travel Group (NLTG). NLTG, which sells 1.5 million holidays in Sweden, Denmark, Norway, and Finland, includes leisure travel companies Ving, Globetrotter, Spies, Tjäreborg, Sunclass Airlines, travel retail Airshoppen, and hotel company Resorts & Hotels, encompassing hotel chains Sunwing Family Resorts, Ocean Beach Club, and Sunprime Hotels.

The € 112.5 million transaction concerns the 4-star Sunwing Kallithea Beach hotel in Rhodes, offering 534 rooms, and the 4-star Sunwing Makrigialos & Ocean Beach Club in Ierapetra, Crete, with 262 rooms. NLTG will continue to operate these units under a 15-year lease agreement, with the option to extend for an additional 10 years. The transaction, financed by the National Bank of Greece, is expected to be completed by the end of this year. NLTG also owns the 4-star, 283-room Sunwing Makrigialos Beach in Lasithi, Crete, and the 5-star, 175-room Sunprime Miramare in Rhodes.

- In May 2024, Mitsis Hotels & Resorts completed the acquisition of the 4-star Messonghi Beach Hotel from the Georgoulis family. Located in the south of Corfu on a 126-stremma plot with direct beach access and adjacent to the Messonghi river, the resort is the largest hotel in Greece, featuring 979 rooms and bungalows. Transaction details were not disclosed.

- Everty Greece finalized a transaction in May 2024, acquiring both 5-star hotels on the Cycladic island of Kea: the 24-room Ydor Hotel & Spa and the 35-room Porto Kea Suites Hotel & Spa. Meanwhile, the luxury One&Only Kea has also opened. Everty's hospitality portfolio includes the Adytum Villas in Porto Heli, the Iconic Santorini, and the Elounda Gulf Villas in Crete.

Main hotel transactions

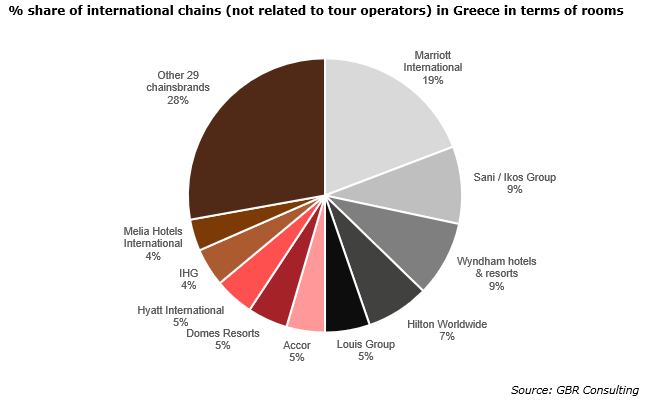

- In July 2024, Hilton announced that it has expanded its portfolio with properties from the Small Luxury Hotels of the World (SLH) collection, now available through Hilton booking channels. SLH has 25 hotels in Greece, increasing Hilton's total properties in the country to 34, with over 2,200 rooms. This includes 8 properties in the Curio Collection and a Tapestry in Chania. With this agreement, Hilton has entered the top 10 of international chains in Greece.

- In terms of international chains that are not tour operator related, we recorded 205 hotels with 29,204 rooms that are part of one of the 39 international chains currently present in Greece.

- In the 5-star category, 20% of the hotels and 26% of the hotel rooms are part of an international chain (not tour operator related), while in the 4-star category, these percentages are 5% and 11% respectively.

|