Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

International arrivals1 at Greek airports, 2014 compared to 2013

RevPAR2 in Greek hotels, 2014 compared to 2013

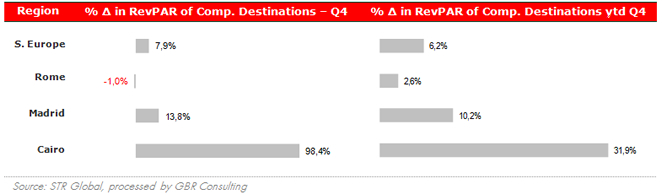

RevPAR in Competitive Destinations, 2014 compared to 2013

Commentary

- The year 2014 was a record year for Greek tourism. Up to November 2014 21.5 international tourist arrivals were recorded (+22.7%), while tourism revenue increased for the first time ever above € 13 bn to € 13.3 bn in the same period (+10.8%). We estimate that the total international arrivals in 2014 will reach 22 mn international tourists spending € 13.6 bn.

- Germany and the UK remained the two main international source markets representing 21% of all international arrivals, followed by France and Russia. Germany and the UK showed increases of 8.3% and 13.4%, while 27.0% more French tourists travelled to Greece. The number of Russian tourists fell by 7.7% due to the fall of the Russian Ruble and the economic insecurity due to the crisis in Ukraine. Long haul arrivals from the Asian countries of South Korea, China and Japan were up by 131%, 107% and 91% respectively, while Brazil recorded +83%, Australia +53% and the US +28%.

- While in 2013 the Athens market reversed primarily due to a recovery in leisure tourism, in 2014 the conference and incentive market also returned, proven by the staggering increase of 28% in business tourism receipts up to September 2014 for Greece as a whole. In comparison leisure tourism receipts increased by 10% over the same period. Thessaloniki benefited from increases in arrivals from Russia, Turkey and Israel, while both Athens and Thessaloniki benefited from significant increases in domestic travel. The segment recorded 21.3% more domestic business and leisure travellers comparing 2014 with 2013. RevPAR in Athens increased 29.4% and in Thessaloniki 16.6% comparing 2014 with a year earlier.

- The resort hoteliers improved their RevPAR with 6.4% in 2014 compared to 2013. The resort hotel sector has proven very resilient throughout the economic and financial crisis in Greece mainly owing to Greece's strong 'sea and sun' product, the spill over effects of the Arab spring, the strong established relationships between hoteliers and tour operators and a well-planned marketing campaign in combination with new air connections attracting also new source countries.

- Finally, the Egyptian market is reclaiming its position in the Mediterranean tourism market, which is also proved by the holiday bookings so far for the destination. Tunisia stays behind in that respect.

Investment highlights of Q4 2014

- Saudi Group Olayan acquired 25% of Costa Navarino by way of a share capital increase, becoming the fourth shareholder of the group. The other three shareholders are part of the Konstantakopoulos family, each holding an equal part. The move will support the next investment stage of Costa Navarino as reported in our earlier newsletters and supply liquidity for the operations.

- In December Kerameia SA, owned by Lou Kolaki applied through Enterprise Greece for permission to move ahead with a plan to build a 5 star hotel and bungalows at Kerameia on the Aegean island of Chios on a plot of 8 ha. Total investment is estimated at € 150 - € 250 mn depending on whether a casino license will be awarded. Enterprise Greece also approved the major strategic investment special development plans of Itanos Gaia in Cavo Sidero, Crete and Kilada Hills in the eastern Peloponnese.

- The Stamatiadi Group, owner of 2 resort hotels in Kalithea on the island of Rhodes, acquired from the Manousou family the 4-star Belvedere Beach Hotel with 212 rooms and the 3-star Rodos Beach Hotel with 168 rooms for € 17.3 mn according to local market reports, which comes to € 45,000 per room. However, the properties will be renovated for an additional € 4 mn.

- Finally, new investments were announced for the construction of 5 star hotel units on the Cycladic islands of Milos, Ios and Kea, in Lasithi on the island of Crete, Rhodes as well as in the town of Sparti in the Peloponnese. The Hellenic Chamber of Hotels confirmed that the total number of hotels has reached 10,000 units in 2014, mainly attributed to the increase of high quality hotels. It is clear that the high end sector will continue its rising course.

Outlook 2015

- The Greek economy is now reported to have grown consistently since the start of the year. GDP was up 0.7% q/q in Q3 (1.4% y/y) making Greece the fastest growing economy in the euro area. For 2014 as a whole EIU estimates a growth of 0.8%. This is lower than earlier forecasts as elections were precipitated constitutionally by the failure of securing sufficient parliamentary support for its presidential candidate. Elections eventually were held on January 25th where the left-wing opposition party Syriza won these elections and formed a coalition with right-wing Independent Greeks.

- Holiday bookings to Greece were initially negatively affected by the Greek elections, but bookings picked up from among others Germany, UK, France, Italy, The Netherlands and the Scandinavian countries. Furthermore, the lower value of the Euro, especially to the US dollar, the British pound and Scandinavian currencies will contribute positively as more than ~65% of international arrivals are coming from outside the Euro zone.

- The Russians will not benefit as the Russian Ruble dropped significantly in value against all major currencies, which will result in a drop of Russian arrivals in 2015. Market sources estimate a fall of 20% in arrivals and 30% in spending this year. Also the recovery of the Egyptian tourism market will effect Greek tourism in 2015.

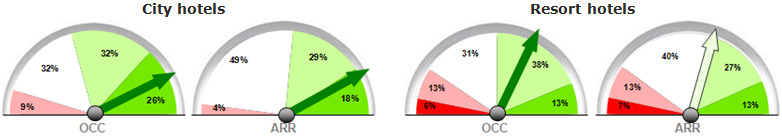

Barometer

- The Greek hoteliers are optimistic though for 2015 based on the Barometer Survey of Q1 2015. For Q1 2015 the city hoteliers are expecting significant improvements in occupancy levels, but are more cautious on their forecast for room rates as only some improvements are being expected for the market overall. For those resort hotels that are in operation in Q1 falling occupancy levels and significant drops in room rates are forecasted.

- However, for 2015 as a whole the market is optimistic. The city hoteliers are the most optimistic as a vast majority is expecting significant improvements this year in both occupancy and ARR levels in continuation of the positive results of last year. The resort hotel segment has forecasted increases in occupancy, but stabilising room rates for this year in comparison with 2014.

Expectations for 2015

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR). |