Introduction

This newsletter provides a snapshot of the performance and outlook of the Greek hotel industry, within the broader context of the international hospitality industry as well as of Greek tourism and Greek socio-economic developments.

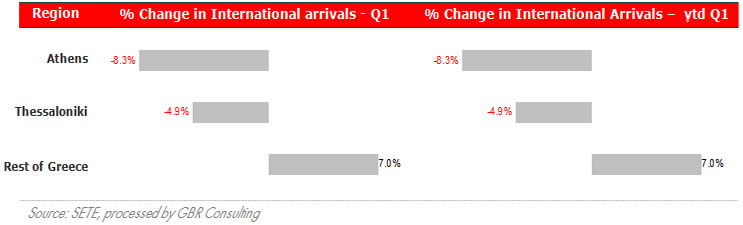

International arrivals1 in Greek airports, 2011 compared to 2010

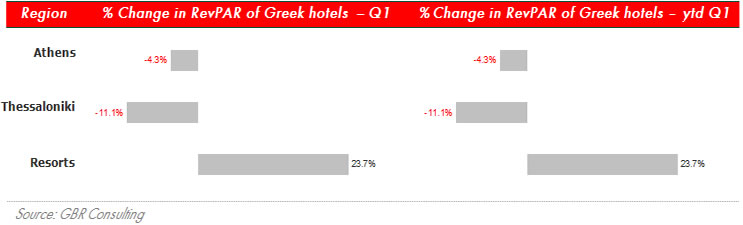

RevPAR2 in Greek hotels, 2011 compared to 2010

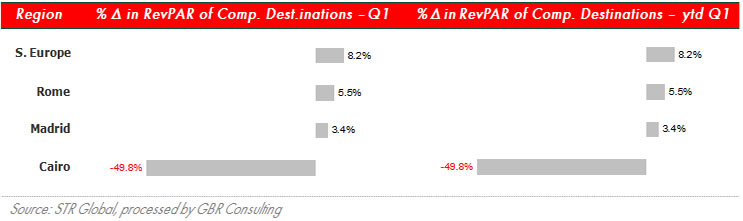

RevPAR in Competitive Destinations, 2011 compared to 2010

Commentary

-

International arrivals by air showed a decrease for the two main cities of Greece, Athens and Thessaloniki of -8.3% and -4.9% respectively. This is mainly due to March, where the drop was the biggest: -17.5% and -11.0% respectively, possibly as a result of the continuing flight of MICE activity from both cities due to the negative image of the country in 2010.

-

In terms of RevPAR the developments for Athens and Thessaloniki were also negative with a drop of 4.3% for Athens and 11.1% for Thessaloniki. The resort hotels, however, started the year very positively with a growth of 23.7% in RevPAR for Q1. Of course, many seasonal resort hotels remain closed but, according to the 2011 Q2 Barometer of GBR Consulting (see below), resort hoteliers expect a strong improvement in performance this year. The Athenian hoteliers are also very positive in their outlook for occupancy, but expect a decrease in ARR. Their collegues in Thessaloniki are less optimistic: they expect a slight increase in occupancy overall, but a steep decrease in their prices. Crete hoteliers were the most optimistic of all in terms of their outlook for occupancy and ARR.

-

These results are confirmed by a survey by The Travel Agents Association of Crete showing winter bookings for this summer increasing by 2 – 4% from Western Europe and 3% - 10% from Eastern Europe. The unrest in North African countries has contributed to this result according to the Association. Note though should be taken that 50% of all bookings are expected to take place during the summer period.

- Finally, the Southern European hotel market is recovering showing RevPAR increases of 8.2% in

2011 Q1. Cairo hotels, due to the unrest in the country, saw their RevPAR decline by 50%.

Hotel & Other News

- According to the Hellenic Statistical Authority (ELSTAT), Greece received 0.6% more arrivals by non residents in 2010 than in 2009. It is interesting though that Europe, responsible for 88.5% of all arrivals in 2010, showed a decline of 2.4% compared to 2009, with arrivals from EU members showing a decline of 6.3%. The largest drop was shown by the UK (-14.7%), Germany (-13.8%), France

(-9.8%) and Italy (-9.8%). The biggest increase was shown by Poland (+97.6%), Russia (63.5%) and Cyprus (32.2%). Asia showed an increase of 5.8% and America 4.6%. Overall, the main source markets of 2010 remained Germany (13.6%) followed by the UK (12%), France (5.8%) and Italy (5.6%).

- Provisional estimates by the Bank of Greece for tourism receipts by non residents were positive for the first two months of 2011 showing an increase of 6.1%. Nevertheless, at € 290 million, they remain 7.2% below the 2009 figures.

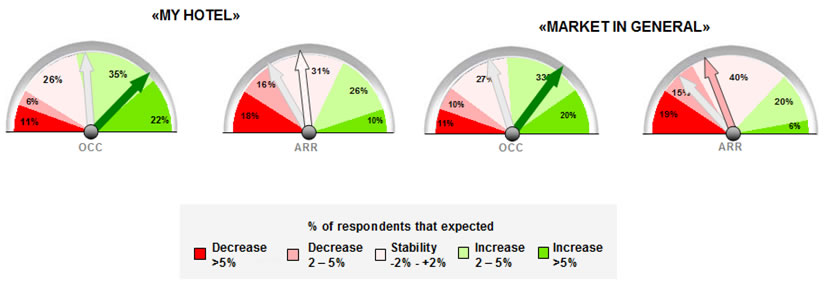

Barometer

-

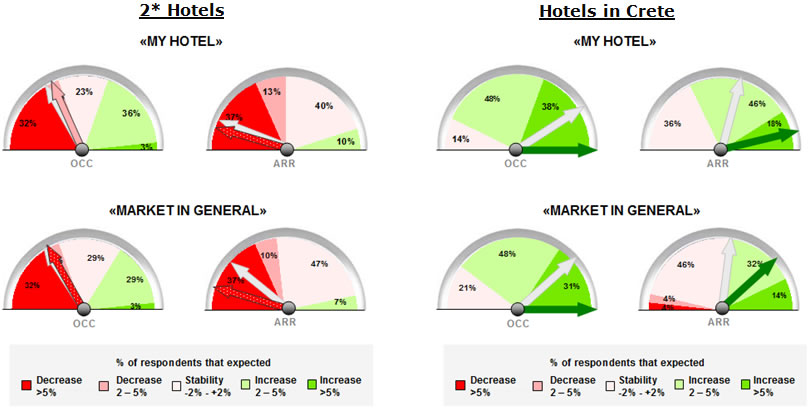

For their own hotels, 47% expects a rise of 2% or more in occupancy, while a similar rise for the market as a whole is predicted by 53%. In addition 26% expects that their occupancy will stabilise, while 27% expects this for the market as a whole. In terms of ARR, hoteliers have become less pessimistic. However, overall hoteliers still expect a slight decrease of their rates, while for the market as a whole they expect a considerable drop, albeit less than 2011 Q1 forecasts.

- Exception to the above are the 2* hotels, who retain their pessimistic outlook for both occupancy and ARR. Crete remains the most optimistic destination, with increased optimism for both indicators.

Endnotes

1 The international arrivals statistics are based on SETE calculations compiling the data from 13 major airports of Greece, representing 95% of foreigners' arrivals by plane in Greece and 72% of total foreigners' arrivals. Thessaloniki airport does not distinguish between arrivals of Greeks and foreigners.

2 RevPAR : Revenue per Available Room; for Greek resorts, calculations are based on TRevPAR (i.e. Total RevPAR). |